Hindenburg Says Indian Regulator’s Legal Notice On Its Adani Research Is Nonsense

Hindenburg Report stands by its allegations that the Adani Group was operating the largest con in corporate history

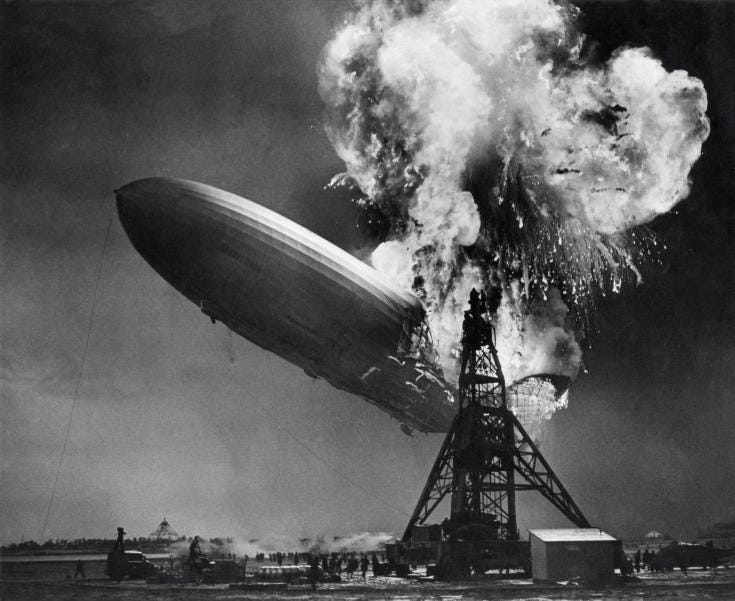

(Photo: The Hindenburg airship* which blew up in 1937 in the USA. Courtesy Wikimedia Commons.)

In January 2023, New York based Hindenburg Research says it “presented overwhelming evidence…of why we believed Indian conglomerate Adani Group was operating ‘the largest con in corporate history.’”

In a post on its site last week, Hindenburg states it “anticipated fierce opposition to our report before we ever published it, regardless of how comprehensive and truthful our body of evidence was.” The stock research firm “was aware that Indian securities regulator SEBI has been grappling with how they are going to respond to us, a U.S.- based research firm with no presence or operations in India…”

Hindenburg’s post was in response to a 46-page show cause letter from the Securities and Exchange Board of India (SEBI), the country’s financial markets regulator, outlining suspected violations of Indian regulations.

Hindenburg says it views the SEBI letter as “nonsense, concocted to serve a pre-ordained purpose: an attempt to silence and intimidate those who expose corruption and fraud perpetrated by the most powerful individuals in India.”

The Adani Group, based in Ahmedabad, India, was founded in 1988 as a commodities’ trading firm, and is run by Gautam Adani, 62-years-old. With $32 billion in annual revenues, the group’s wide range of businesses includes owning power plants, transmission lines and coal mines; cement and real estate businesses in India and abroad; operating the Mumbai airport and other airports; and Mundra, India’s largest port and other ports.

In 2014, Adani’s net worth was $2.8 billion, according to Forbes. He is from Gujarat. That year Narendra Modi, the former Chief Minister of Gujarat, took over as India’s Prime Minister. Adani “has profited since fellow Gujarati Narendra Modi, India’s most influential prime minister in decades, took office in 2014,” according to AP News.

By September 2022, Adani’s net worth rocketed up more than 50-fold to $152 billion, according to Forbes. His current net worth is $85 billion, according to the magazine.

In 2022, Adani took control of NDTV, an independent news channel founded by Prannoy Roy and his wife Radhika Roy, both journalists. Unlike the other major media channels in India, which are owned by business groups, NDTV's channels, one in Hindi and one in English, carried critical reports as well as featured those opposing Modi government’s policies and actions. Prior to its purchase by Adani, NDTV was hit by numerous legal cases that its owners said were a result of its reporting.

Its 2023 report, Hindenburg states, offered details alleging that Adani “engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades.”

“The report provided evidence of a vast network of offshore shell entities controlled by Gautam Adani’s brother, Vinod Adani, and close associates. We detailed how billions were surreptitiously moved through these entities, into and out of Adani public and private entities, often without related-party disclosures.”

“We also detailed how a network of opaque offshore fund operators surreptitiously helped Adani evade minimum shareholder listing rules, citing numerous public documents and interviews to substantiate the allegations.”

SEBI’s letter alleges that Hindenburg “sensationalized or distorted certain facts” by using the word “scandal” to describe an “alleged INR 6.8 billion scheme by Adani that resulted in a 239-page order from the Commissioner of Customs detailing evidence of fraud, an INR 250 million (U.S. $4.6 million) fine, and extensive subsequent legal proceedings.”

The 2023 Hindenburg Report “pointed out a 2007 SEBI ruling alleging that promoters of Adani worked with Ketan Parekh, perhaps India’s most notorious stock market manipulator, to manipulate shares in Adani. Our report explained how Adani Group entities initially received bans for their roles, but these were later reduced to token fines. Once again, SEBI did not allege any aspect of this was false.” Rather, Hindenburg states, SEBI claimed that it was a misrepresentation to call the reduction in punishment “leniency.”

SEBI also stated the 2023 Hindenburg Report was not false, but rather “reckless” for quoting a banned broker with specific experience dealing with SEBI, according to Hindenburg. The broker described to Hindenburg how SEBI was “fully aware that firms like Adani used complex offshore entities to flout rules on minimum public shareholder ownership, and that the regulator participated in the schemes due to bribes,” according to Hindenburg.

(Image: Courtesy Creative Commons.)

After the Hindenburg Report, in August 2023, Deloitte resigned from its role as statutory auditor for Adani Ports, citing undisclosed related-party transactions “flagged in our report as the basis for a qualified opinion that accompanied its resignation,” according to Hindenburg.

Hindenburg adds that “at least 40 independent media investigations corroborated or expounded on our findings, presenting evidence of widespread fraud by Adani against shareholders and Indian taxpayers…”

“Prior to the release of the Hindenburg Report, concentration in short-selling activity was observed in the derivatives” of Adani Enterprises (AEL), the letter states. “Pursuant to the release of the said Report, the price of AEL fell by around 59% during the period from January 24, 2023 to February 22, 2023.“

Hindenburg states that It holds positions in equities in advance of publishing reports and “stands to realize significant gains in the event that the price of stock moves.” So, assuming it had a short position in Adani, Hindenburg likely made a good gain upon covering it, that is buying back the derivatives at a far lower price than the price at which it earlier sold the derivatives.

Since 2016, Hindenburg has published critical reports on several companies. On its website, it lists several cases where its research led to declines in company valuations and fines and other punitive actions by regulatory authorities. In 2020, one of the reports “called out a vast array of alleged lies and deceptions by Nikola in the years leading up to its proposed partnership with General Motors.”

In 2022, a U.S. jury convicted Trevor Milton, the founder of the electric vehicle start-up Nikola, of “fraud over allegations he lied to investors,” Reuters reported. In 2021, Nikola agreed to pay $125 million to settle with the U.S. Securities and Exchange Commission over its representations to investors. Nikola went public in 2020, reaching a peak stock market valuation of $34 billion some days later. It now has a value of $400 million.

“To this day, Adani has still failed to address the allegations in our report, instead providing a response that ignored every key issue we raised,” Hindenburg states in a post last week.

Discussing the role of SEBI, Hindenburg notes, “One might think that a securities regulator would be interested in meaningfully pursuing the parties that ran a secret offshore shell empire engaging in billions of dollars of undisclosed related party transactions through public companies while propping up its stocks through undisclosed share ownership via a network of sham investment entities.”

“Instead, SEBI seems more interested in pursuing those who expose such practices. This stance is broadly in line with the actions of other elements of Indian government which have sought to arrest 4 journalists for writing critical articles about Adani and expelled members of parliament who were critical of Adani.”

How Hindenburg Research got its name, according to its site: We view the Hindenburg as the epitome of a totally man-made, totally avoidable disaster. Almost 100 people were loaded onto a balloon filled with the most flammable element in the universe. This was despite dozens of earlier hydrogen-based aircraft meeting with similar fates. Nonetheless, the operators of the Hindenburg forged ahead, adopting the oft-cited Wall Street maxim of “this time is different”.

We look for similar man-made disasters floating around in the market and aim to shed light on them before they lure in more unsuspecting victims.