Why an Expected Decline in Crude Oil Prices May Not Benefit India

Lower crude oil prices will reduce demand for Indian labor in the Middle East countries and worsen India's foreign debt says Ignatius Chithelen

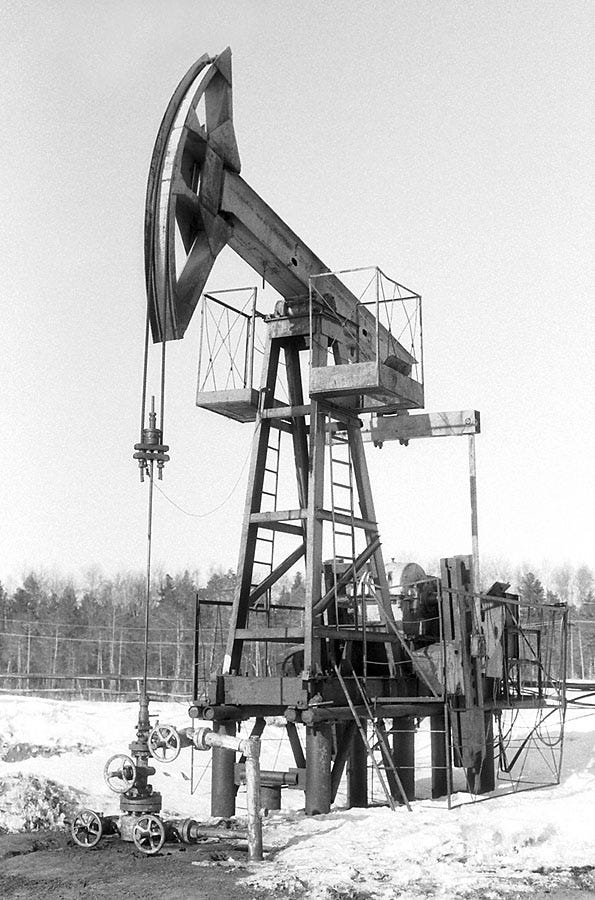

(Photo: oil rig, courtesy Wikimedia Commons.)

January 5, 2025

By Ignatius Chithelen*

In about a decade, supply of crude oil is expected to exceed demand. On the supply side, global recoverable oil reserves are abundant, more than 1,500 billion barrels, according to RystadEnergy.

Meanwhile, demand is expected to peak due to rising use of electric vehicles (EV), especially in China. U.S. investment bank Goldman Sachs forecasts that demand will peak in 2034 around 110 million barrels per day (bpd), up from 100 million bpd today - maybe even later in 2040, at around 113 million bpd, if EV adoption slows down.

The plateau - possibly a decline - in demand is a decade away. While there could be short-term spikes, the supply demand imbalance is already reflected in futures prices. For instance, December 2034 West Texas Intermediate crude futures trade at $61 per barrel, about a fifth lower than the current price.

In theory, a long-term decline in oil prices should be a boost for the Indian economy. The country imports 90% of the 5.4 million bpd it consumes, according to the International Energy Agency (IEA). Currently about half of India’s imports come from Russia, at a roughly 15% discount to world market prices, notes S&P Global. In fiscal year ending March 2025, India’s oil imports is estimated to total roughly $140 billion, according to Business Standard.

By 2030, India’s oil consumption is forecast to rise by a third to more than seven million bpd, mainly due to rising demand for transportation fuel. Given lack of domestic reserves, India’s oil imports are forecast to rise by about half to 6.6 million bpd, according to the IEA. So, due to rising import volumes, a drop in oil prices may mean India’s oil import bill is unlikely to rise as sharply as it has in the past.

(Photo: a coal power plant in India. Courtesy Wikimedia Commons.)

Almost all of India’s oil imports are refined domestically. Government-run as well as privately owned companies, including Reliance Industries, have set up 257 million metric tonnes (mt) of annual refining capacity in India.

About three quarters of India’s refined products are consumed domestically, chiefly for transportation fuels; also, cooking and aviation fuels, plastics, and other petrochemicals. Such domestic production helps reduce India’s import bill.

About a quarter of India’s refined output is exported. By 2030, Indian companies plan to expand refining capacity to 295 million mt, by investing more than $26 billion, according to CRISIL Ratings.

In fact, India’s long-term plan is to raise refining capacity to 450 million mt according to a government official, Reuters reported. Part of the additional capacity is to meet rising domestic demand and further reduce imports. Also, the official added, India has ambitious plans to be a major exporter, by replacing refining capacity which Western countries may shut to meet green energy goals.

But India’s refined product exports compete with those from low cost producers. Saudi giant Aramco’s cost of a barrel of oil is between $2 and $10 and the average cost for Russian producers is $15. In contrast, Indian refiners pay around $70 for each barrel they import. By 2035, even if Brent prices decline by half to around $35 and stay there, the input cost for Indian companies will continue to be higher than those for their Saudi and Russian competitors.

Also, since refining is an energy intensive operation, production costs are higher in India. The country faces major power shortages even with expanding generation of cheap, polluting coal power - which runs contrary to a government pledge to achieve net-zero carbon emissions by 2070.

The impact of competing against low-cost exporters is already evident. In the first half of the current fiscal year ending March 2025, prices of Indian refined product exports averaged $312 per metric tonne, nearly two thirds lower than in the year ago period, according to data from India’s Ministry of Petroleum.

Overall, in the current fiscal year, India’s refined product exports are forecast to total roughly $70 billion, a third lower than in fiscal year 2023. This despite the volume of exports estimated to rise to 120 million tons in fiscal year 2025, a fifth higher than in fiscal year 2023.

The sharp decline in prices implies that Indian companies are currently exporting some, if not all, of their refined products at a loss. This raises a question: is it the government-owned companies - which account for nearly two thirds of India’s refining capacity - who are exporting at a loss? Private companies are unlikely to export at a loss, unless they get government subsidies and/or tax-benefits to ensure they earn profit margins of 12% or higher, which is typical for their sales in India.

The Indian policy of using scarce capital to fund government-run companies to expand loss-making refining capacity is a flawed business strategy. Instead, the capital should fund job-creating export businesses, which enhance the value of local products. For instance, India acutely needs a cold-chain to extend the life of vegetables, fruits, food grains and dairy and other farm products.

(Photo: an oil truck in India. Courtesy Wikimedia Commons.)

In 2013, during a short span of four months, between May and August, the Indian Rupee fell by 30% to Rs. 69 for one U.S. dollar. This was due to fears about the current account deficit, which ballooned to $88 billion, or 4.8% of India’s then $1.8 trillion Gross Domestic Product (GDP). The deficit rose because India’s oil import bill climbed to $109 billion in 2013, a five-fold rise over the previous decade.

The Rupee has continued falling, down by more than 15% over the past decade - today one dollar buys Rs.86. This decline is due to rising budget and current account deficits. Soaring budget deficits has expanded Indian government debt to more than four fifths of the nation’s $3.9 trillion gross domestic product, according to the International Monetary Fund.

Due to continuing current account deficits, India’s foreign debt totaled $647 billion at year end 2023, 50% greater than in 2013, according to World Bank data. The rise in the current account deficit is partly due to the higher cost of oil and gas imports. Currently, while crude oil trades a third lower than the $110 average in 2013, the volume of imports rose by three quarters over the past decade. Also, roughly half of India’s annual ten trillion cubic feet of natural gas consumed is imported; at a cost of $13 billion in fiscal year 2023-2024.

However that year, the current account deficit was relatively small, $25 billion. This was mainly because $125 billion was sent by Indian workers in the Middle East to their families in India, according to data from The Financial Express.

In 2020, when oil prices collapsed, millions of Indian workers were sent home by the Middle East countries. As a result, that year, there was a sharp decline in the remittances from the region to India; for instance, a drop of 17% from the UAE. As oil prices recovered, the number of Indians working in the Middle East is back up to pre-pandemic levels.

Today, there are nine million Indians, with about a third from the state of Kerala, employed in the oil-exporting Middle East countries. Since the 1980s, such jobs, which pay twice or more than comparable wages in India, have also helped ease the country’s massive unemployment problem.

In about five years, as revenues from crude oil exports start a long-term decline, the Middle East countries will likely start laying off foreign labor, including from India. This time, unlike in 2020, such job losses will be permanent. Fewer jobs for Indians in the Middle East will worsen unemployment in India as well as India’s current account deficit.

Apparently hoping to benefit from the coming decline in oil prices, Prime Minister Narendra Modi’s government plans to boost India’s refined product exports. Does the government also have a plan to create domestic jobs for millions of Indians who will likely be forced to return to India from the Middle East countries?

(Story updated January 10, 2025.)

*Ignatius Chithelen is author of PASSAGE FROM INDIA TO AMERICA and SIX DEGREES OF EDUCATION. He manages Banyan Tree Capital, New York, which currently has no positions in any investments related to the issues covered in this article.